Construction Contracts Amendment Bill (Retention Money) 2021 & Construction Bonds

asBuilt attended the 2021 NZIQS conference in Rotorua with our two software products, Vault and PayLab, at the start of July. One of the highlights for the PayLab team was a presentation on the proposed amendments to the CCA and connecting with Peter Degerholm's, a leading educator in the field of Construction Legislation.

We have been following the legislative process around the CCA amendments since early June, and it looks like it will come into force around the second quarter of 2022. The 2021 bill, which builds upon the previous Construction Contracts Amendment Act 2015, addresses some of its shortcomings and loopholes, following further construction company failures since it came into place. The PayLab team will be developing added functionality to satisfy the new reporting requirements around retentions.

Here is a summary of the main changes and how PayLab is equipped to deal with these:

| Amendments to the Construction Contract |

Updates to PayLab |

|

Retentions are trust property, this will happen automatically at the point of deduction. |

PayLab is updating its certification output for relaying this information to the payee in the Payment certificate. |

|

Retentions must be kept in a separate bank account, the name of which must include in words Retention Money Trust Account. |

PayLab is updating its retention set up workflow for populating this data in the project record. |

|

A Payer holding retentions must give detailed quarterly reports to Payees on their retention money. |

PayLab already keeps the user updated with the current state of all retentions across all projects and can report on retentions at any time. Automated quarterly reporting or prompting the Payer is further functionality that PayLab will look to add to meet these quarterly reporting requirements. |

|

If a Payer holding retentions becomes insolvent the Receiver or Liquidator will become the trustee for receiving and distributing retentions to creditors. |

This process becomes easier due to the fact that the details of the trustee and accounts are recorded in the retention details. |

|

Fines for directors of companies that fail to keep retentions in a separate account (up to $200k), to keep proper accounting records ($50k), or provide quarterly reports ($50k). |

PayLab will help you avoid fines and keep you compliant. |

|

Payment schedules/certificates will need to record the deduction of any retentions, and include details such as bank, account name and number, together with a statement that the Payee may inspect the Payer’s accounts and records. |

PayLab is updating its certification output for relaying this information to the payee in the Payment schedule/certificate. |

|

Payers holding retentions will need to set up proper accounting and reporting systems, and set up processes to ensure retentions (being trust money) are not misused and are properly released when due. |

PayLab is the perfect tool for retention reporting. |

|

QS’s and Engineers to Contract will need to include statutory information in payment schedules. |

PayLab is updating it Payer approval workflow to include multiple approvals populated with statutory information and reasons for variance. This output data will be reflected in the Payment schedule/certificate for the payee. |

How Does PayLab Currently Deal with Retentions?

PayLab is currently well set up to document and track retentions from both a Payer and Payee point of view. Once set up, retentions are deducted according to the percentage formula and is shown in both the Claim and Certificate summaries.

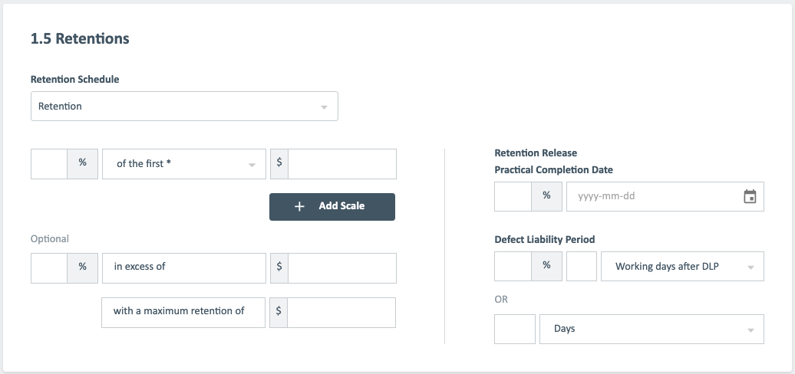

Figure 1: Retention set up when creating a project

Figure 1: Retention set up when creating a project

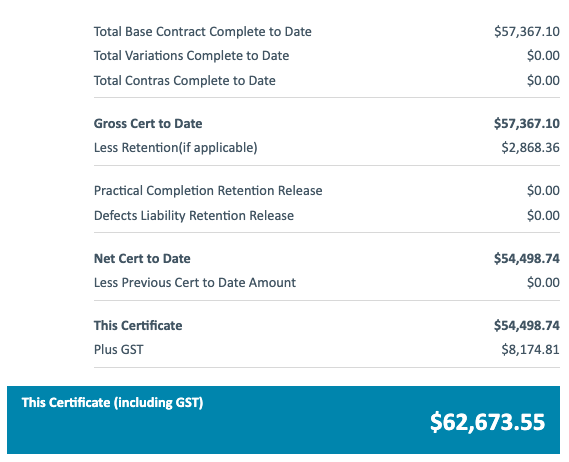

Figure 2: Certificate Summary above right showing retentions.

Figure 2: Certificate Summary above right showing retentions.

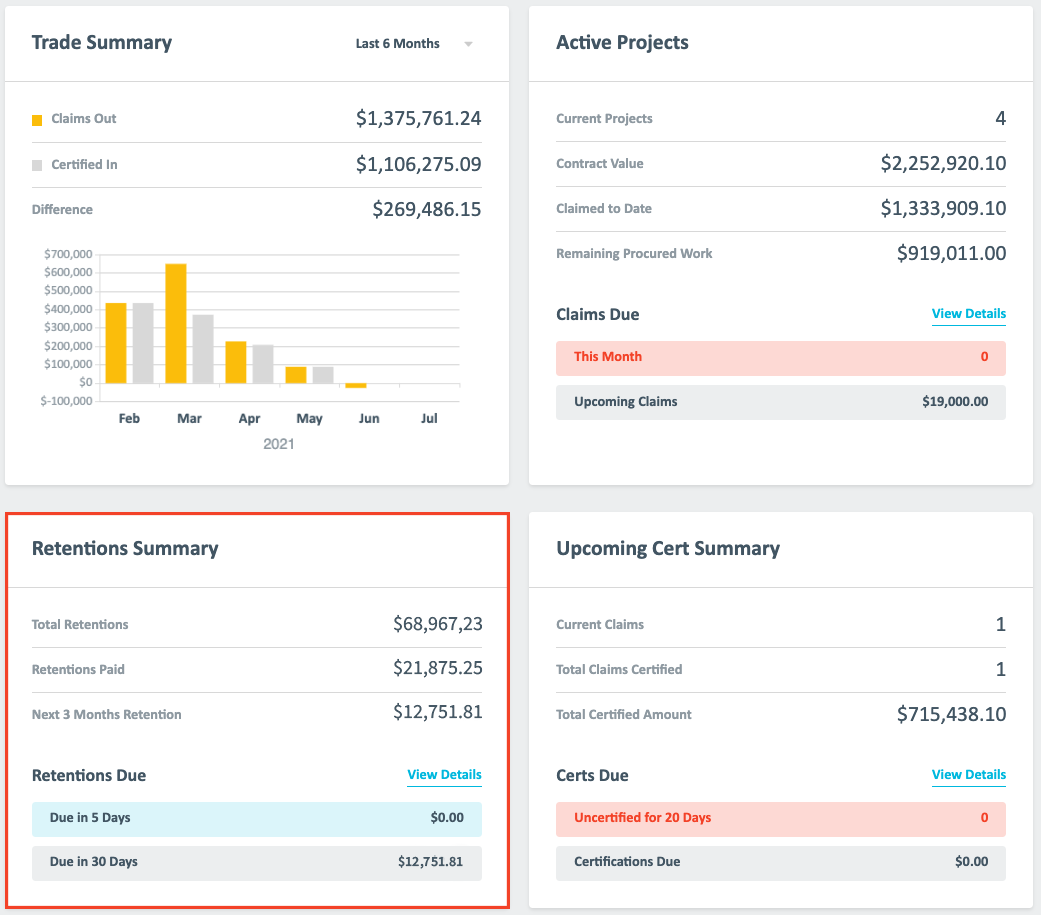

Figure 3: An overview of total retentions across all projects.

Figure 3: An overview of total retentions across all projects.

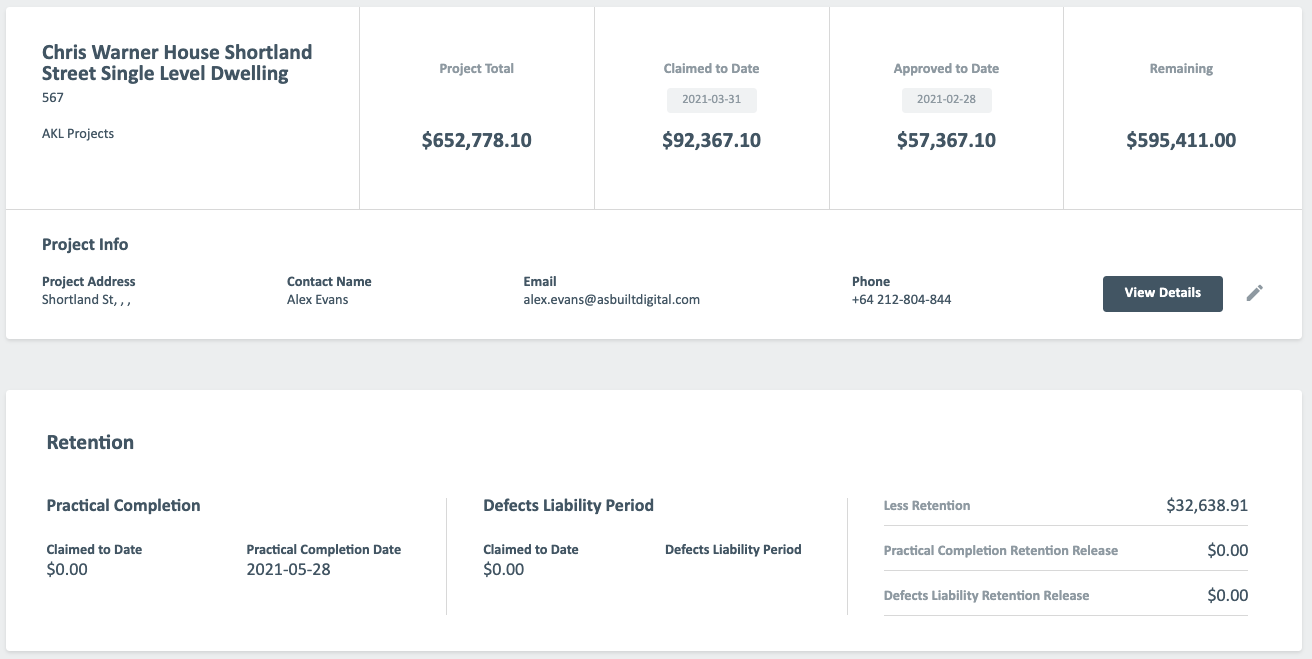

Figure 4: An overview of total retentions for a single project.

Figure 4: An overview of total retentions for a single project.

PayLab Future Functionality for CCA Amendments Adherence

Going forward PayLab will include increased fields for retention account information to improve reporting around retentions to align with the proposals in the amended bill and have it in place when it becomes an Act.

- Third party trust account details, bank assurance information to be included in the PayLab retention set up.

- Quarterly reports generated from the project showing extent of retentions for individual subcontractors.

- Retention reminder notifications on both Main Contractor and Subcontractor side for quarterly reports. (PayLab already has retentions notifications in place when it comes to Practical Completion and Defects Liability).

The Construction Bond – A Possible Outcome of the New Retention Regime

The team at PayLab also anticipates as a result of the proposed new amendments around retentions, that Main Contractors and Subbies will explore other options such as the Retention Bond, also known as a Construction or Performance Bond.

How It Works

Retention Bonds are way of avoiding problems associated with retention recovery. Amounts that would otherwise have been held as retentions are instead paid in line with progress, with a bond being provided to secure the amount. Similar to the retention, the bond’s value will usually reduce after the certification of Practical Completion and eventually be cleared of all liability at the finish of the Defects Liability Period – all going well of course. Naturally warranties and guarantees still stand for their duration.

Only if Practical Completion is not achieved by the Subcontractor or if they prevent a Certificate of Making Good Defects from being issued will the Retention Bond take effect. The Contractor is then able to ‘call’ on the Retention Bond.

A Subcontractor is usually allowed a fixed period of time to rectify any defects, and this is stipulated by the Retention Bond. Should they fail to rectify the defect, the Retention Bond can be called on by the Contractor and the surety must cover the remedial costs, before then pursuing the Subcontractor.

Whilst Subcontractors must pay the surety’s premiums, the benefit to them is that they do not have to chase retention monies post-completion, and no retention monies will be withheld. This cash flow security is often seen as worth the cost of the premium. Similarly, Retention Bonds are advantageous to Contractors in improving the cash flow and financial stability of the Subcontractor, making them less likely to default on the works.

Retention Bonds include a fixed expiry date, making it clear when the Subcontractor is released from its obligations.

Retention Bonds may also be used as an alternative to retention between the employer and the Main Contractor.

PayLab will look to include the recording of Retention Bond details as an option in future updates, as part of the Project workflow setup.

To learn more about how PayLab can help simplify and streamline your Claiming and Certifying process head over to our website

Until next time - happy claiming and certifying!

If you want to read more of our adventures as we attempt to create A Smarter World, Digitally then subscribe below and follow us on asBuilt - Linkedin and PayLab - Linkedin.

COMMENTS